EXECUTIVE SUMMARY

Direct-to-consumer (DTC) brands are shaking up the retail landscape with their ever-increasing presence in almost every consumer product category. They are posed to disrupt today’s retail model by cutting out the middlemen and retailers in the distribution channel and owning 100 percent of the relationship with their customers.

DTC brands differ from traditional legacy brands in three aspects: product development, marketing and distribution.

- DTC brands are obsessed with getting their products right, but they do not strive for a large product portfolio.

- Social media is used as the main marketing vehicle for DTC brands, who also have distinctive brand identities with witty slogans and millennial-style aesthetics.

- DTC brands usually live exclusively online. But recently they are flocking to offline channels with pop-up or brick-and-mortar stores.

The timing of the DTC boom is not coincidental, as many social changes and the commercialization of new technologies provide a breeding ground for DTC brands.

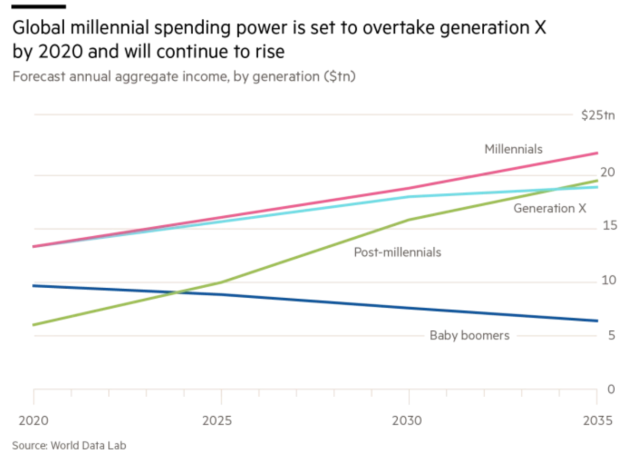

- Millennials and Generation Z are the rising consumer segments with increasing purchasing power and influence on the retail landscape.

- Society as a whole is demanding more transparency, respect for the environment, and equality from businesses. The incumbent brands are widely deemed as the culprits for issues like environmental deterioration and social injustice.

- The commercialization of information technologies is drastically lowering the cost and technical barrier to entry for DTC brands.

As the competition between DTC brands heightens, challenges start to emerge for them.

- The marketing cost of DTC brands is growing steeply.

- As more and more DTC brands compete in the same product categories, it has become increasingly difficult for brands to differentiate themselves from competitors.

- The complexities of supply chain management could set back the growth of DTC brands.

- DTC founders’ exit strategies might be thwarted by excessive funding from venture capitalists, who are not necessarily familiar with the industries these brands inhabit.

The success stories of DTC brands provide a rich learning ground for legacy brands, where both challenges and opportunities could emerge.

- Challenges on the horizon: legacy brands risk losing their relevance with their customers in terms of product development, marketing strategy, and most importantly, their brand identity.

- New opportunities: legacy brands should identify the gaps in their incumbent strategies for product innovations, marketing and distribution, then leverage the DTC model towards realistic goals to complement their business strategies.

Over the past few years, a distinctive type of retail brand emerged and is quickly on the rise, posed to shake up the entire retail industry. These brands are hard to come across at regular retail stores, but they are catching our eyes everywhere on social media and buzzing websites. They are hard to pass up with their nifty product design, fresh-looking aesthetics and witty slogans. Most importantly, they are replacing many household consumer brands in people’s mind and amassing large-scale popularity. They are called direct-to-consumer (DTC) brands.

.

WHAT ARE DIRECT-TO-CONSUMER BRANDS?

“Its primary means of interacting, transacting, and story-telling to consumers is via the web. The digitally native vertical brand (DNVB), is born on the internet. It is aimed squarely at millennials and digital natives. It doesn’t have to adapt to the future, it is the future.” – Andy Dunn, Founder of Bonobos

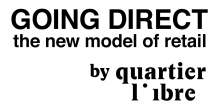

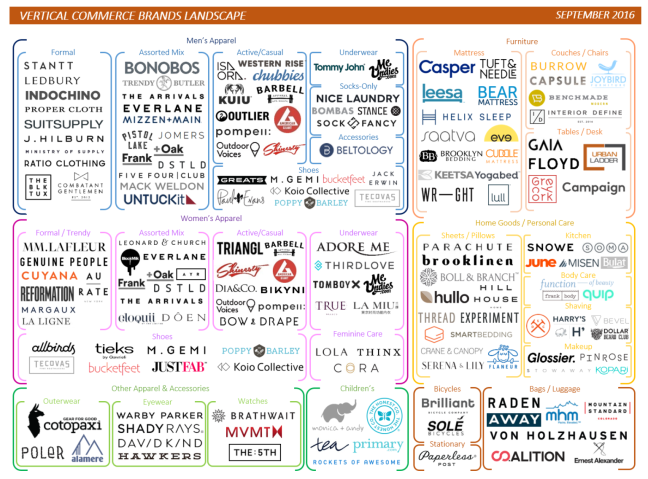

DTC brands, or sometimes called digital native vertical brands (DNVB), a term coined by Bonobos founder Andy Dunn, are brands that design, manufacture, market, sell and ship products directly to consumers. The “direct” in this name is in contrast to the traditional retail model, where brands typically distribute through layers of wholesalers and their products eventually end up on shelves or racks at multi-brand retailers. The core concept of the DTC model is to cut out middlemen and to own the relationship with customers with immersive and interactive marketing. Today, DTC brands are disrupting almost every product category that touches our daily lives, from apparel to personal care products, from mattresses to personal genetics testing.

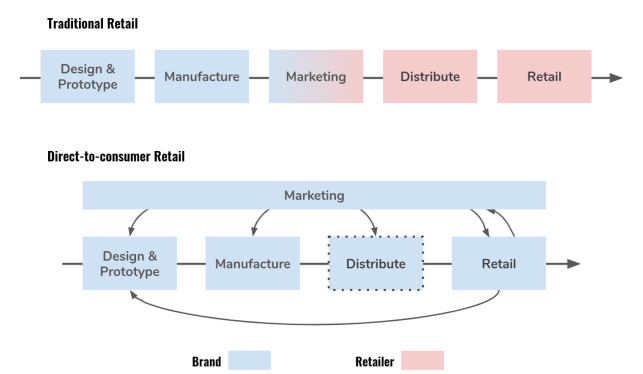

The conceptualization of DTC brands usually follows a certain formula: find a sleepy product category that has historically bad user experiences, opaque pricing structure or shady business practices. Upon identifying these customer pain points, DTC brands will then re-design the product features, production processes or pricing structures, in the end coming up with an improved product or service that is better in performance and quality, with competitive pricing, delivered with simplicity and millennial aesthetics. With their direct interaction with the customer throughout the browsing and transaction phases, DTC brands are able to extract valuable customer insights that can in turn be fed into improvements on product development and marketing strategies.

.

HOW ARE DTC BRANDS DIFFERENT FROM TRADITIONAL BRANDS?

During the product development, marketing and distribution phases, there are a few key divergences that DTC brands make that differentiate themselves from traditional bands.

PRODUCT DEVELOPMENT

Although founding a DTC brand sounds as straightforward as following a formula, making a decent product is always a key differentiating starting point that requires non-trivial efforts. DTC brands are obsessed with getting their products right, thus they widely adopt a very hands-on approach with their product development. Some brands will even go into much depth to source their own raw materials in order to ensure their quality and ethicality. For example, Naadam, a DTC brand that sells luxury knitwear, directly sources raw cashmere from nomadic farmers in Mongolia for the production of premium cashmere sweaters, cutting out the murky process of dealing with cashmere traders who charge substantial markups for cashmere with questionable quality or sources.

In the early age of the DTC boom, many founders have little if not zero experience in the industries that their companies inhabit. However, they all have first-handedly either experienced bad user experiences, held safety concerns or disagreed with the business conduct of the incumbents once as customers themselves. For example, actress Jessica Alba founded The Honest Company out of her frustration with the difficulty in finding childcare products that are safe, eco-friendly and affordable; Michael Preysman founded Everlane after the realization that the fashion retail industry is broken with opaque distributor networks and high price markups while working at a private equity firm. With their eyes as fresh as their customers’, these founders have a very clear vision for what a good product is, and they are committed to making one.

When it comes to product portfolio, DTC brands also hold much skepticism towards “the more the merrier” philosophy commonly accepted in retail that aims to “spoil” customers with a wide range of options. Instead, DTC brands opt for a lean product portfolio that specifically targets their champion customers, as opposed to trying to appeal to every single customer profile. This strategy allows DTC brands to really hone in on their product offering and cultivate a loyal following with limited resources when the brand is just starting out. Their product portfolio will eventually grow as the brand scales, but at a discreet pace that is heavily informed by the first-party data that the brands have collected from every interaction they have had with the customer.

MARKETING STRATEGY

In the pre-DTC era, brands relied heavily on mass media, such as TV, radio, newspaper, magazines and outdoor advertising to reach their customers. Big brands would shell out massive marketing budgets trying to own customers’ attention by blasting out advertisements in every possible media outlet. However, this carpet bombing strategy is very costly, and it misses its target customers by and large. In comparison, as digital natives, DTC brands use social media as the main marketing vehicle, and they are savvy at using data analytics to tailor the message towards different customer profiles. As a result of this precise targeting mechanism, DTC brands are able to create much more brand relevance for customers and a higher conversion rate at a lower cost.

DTC brands are also exceptional at soliciting emotions from and the affinity of customers through storytelling. DTC brands strive to cultivate a transparent and authentic brand image, as they tend to document their journey of creating products and show customers what goes behind building the brand. Some DTC brands would even go as far as sharing business information that would otherwise be classified as “trade secrets” or “confidential” in the traditional business world. For example, Everlane breaks down the cost items of making their garments and shows them to its customers. On its website, the brand also shows the factories where their garments are made. By demystifying their industries, DTC brands are able to gain trust and respect from their customers more easily. Even during times of struggles and missteps, DTC brands do not shy away from sharing their mistakes. Instead, they express their learnings and publicize the action plans resulting from their setbacks. Consumers are also usually more forgiving towards DTC brands, as they sympathize with brands’ efforts in overcoming obstacles.

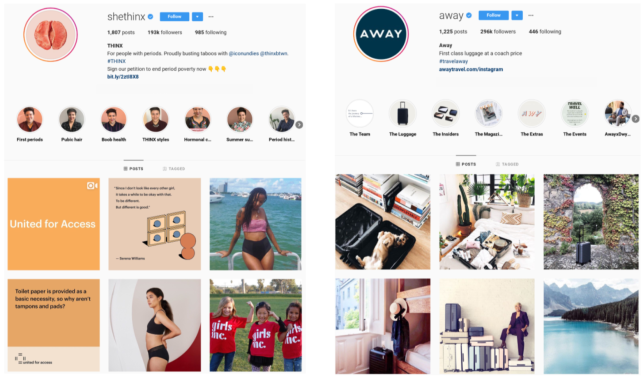

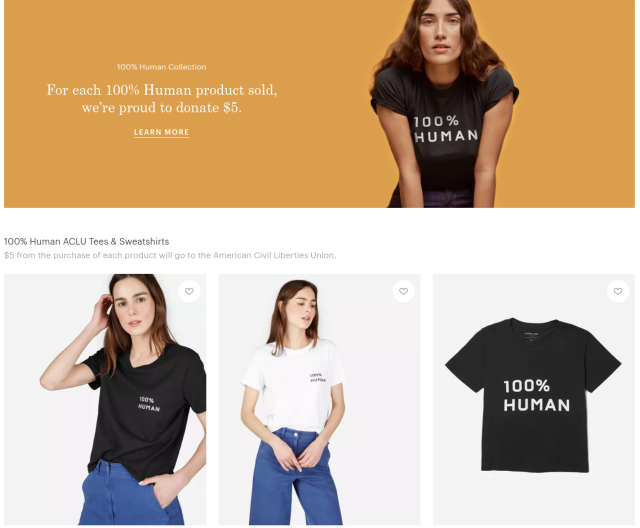

Last but not least, DTC brands are not fixated on marketing solely on their product features. Instead, they strive to become the tastemaker, the lifestyle guru, a friend who understands and inspires you. Browsing through these brands’ Instagram posts, you can expect to see not only beautiful pictures of their products, but also artworks of famous artists, inspiring quotes from significant figures throughout history, interviews with influencers across industries, and sometimes even political statements that brands express to show their stances. DTC brands have essentially created a larger-than-life brand image that is much more than about just selling their products. The aspirational effect they have created among their customers means that brands can lead the customers in terms of envisioning their needs, instead of chasing after the needs of their customers.

DISTRIBUTION CHANNELS

As DTC brands are always hungry for direct customer interactions and obsessive with being on-brand with every interaction, they need to exert a direct control of their distribution channel. When starting out, many DTC brands tout a “digital-only” strategy, since they believe that online-only interactions with their customer are logistically simpler, cheaper and efficiently on par with in-person interactions at physical stores. However, as the competition heightens in the DTC landscape, the customer acquisition cost (CAC) is increasingly approaching the overhead cost of running a physical store. Hence, more and more DTC brands start to see the opening of brick-and-mortar stores as a viable option and adapt to a “digital first, physical second” strategy.

The proliferation of pop-up stores as a temporarily physical retail format nowadays is favored by DTC brands, where brands can test out store display and in-person interaction strategies with customers before committing to opening permanent stores. Many brands have achieved sizable success with pop-up stores before they expand into the permanent offline distribution channel.

Many early DTC players are gaining significant momentum in their offline distribution channel: Casper is set to open 200 stores nationwide in the US in 2018, and Warby Parker is approaching a 100-store milestone. Many brands have discovered synergy between the online and offline channels, as they have seen an increase in their online sales with the opening of physical stores. All of this serves as a key takeaway that customers today still value tactile shopping experiences. By tapping into the offline distribution channel, DTC brands can couple the learnings about their customers in in-store environments with the customer insights extracted from online interactions.

.

WHY ARE DTC BRANDS EMERGING NOW?

Today’s consumers are changing, and DTC brands are quick at identifying and targeting these changes in macro consumer trends.

MILLENNIALS AND GEN Z ARE ON THE RISE

One of the changes is the shift of the consumer base. Millennials and Generation Z are becoming two important forces with increasing purchasing power. It is estimated that the millennials in the US will have a purchasing power of $1.4 trillion by 2020, representing 30% of all domestic retail sales. Gen Z consumers in the US today are currently spending $500 billion a year, exceeding the GDP of countries like Belgium and Sweden.

These two generations of consumers are excited about novelty brands and are highly visually-oriented. They are bored with many big household brand names and the traditional CPG product aesthetics that they grew up with. As an alternative, the minimalist and sleek packaging design offered by DTC speaks strongly to millennial and Gen Z consumers.

At the same time, as the most technologically-immersed and internet-informed generations, millenials and Gen Z demand transparency and are highly alert of shady brand practices that cause environmental and inequality issues. Millennials and Gen Z are also immensely social, both online and offline. DTC brands that have a conversational style of communication with them are more likely to gain their affinity than brands who talk down to them via traditional one-way media outlets, such as on TV or radio broadcasts.

INCREASED SCRUTINY FROM CONSUMERS

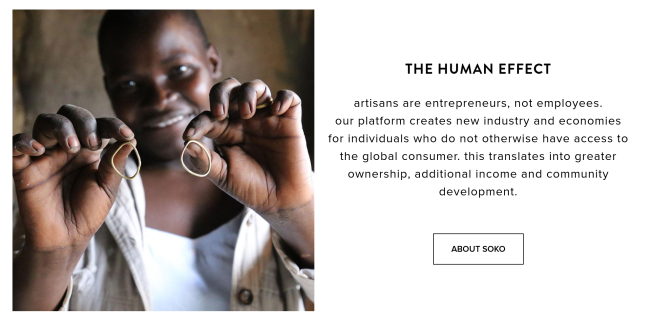

Society-wise, a deteriorating environment, the widening gap of inequality and tumultuous geopolitics are reshaping people’s views on the impacts of consumerism and capitalism fueled by big corporations on today’s ecology and sociology. A common distrust of big brands prevails among consumers, as people believe that big brands are largely responsible for these dire situations that we are in today with the lack of operational transparency and laxed governmental regulation. In contrast, independent DTC brands are extremely open and forward-thinking. Many brands preemptively carry a social mission with their products and services, to either reduce their environmental impacts or use ethical labor for production. DTC brands’ notion of “giving back” to society really strikes a chord with today’s altruistic consumers who engage themselves with others on a more global scale.

Additionally, the concept of ownership is losing its stronghold, as more and more shareable products are replacing the necessity of ownership. People are buying “fewer but better” goods. Highly aware of these social trends, many DTC brands are aspiring to set up new best practices in retail with environmentally-friendly products, ethical production practices, transparent pricing and community-centric focus that defy the old and arcane business practices of big brands.

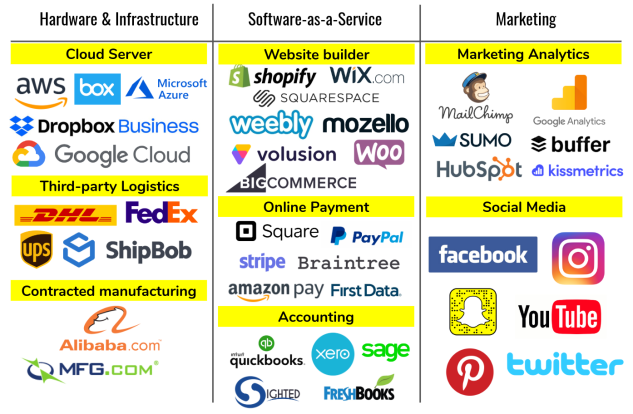

TECHNOLOGICAL READINESS

The fast development of DTC brands can also be attributed to the technological innovations in IT services and infrastructure which drastically lower the cost of running a business. At the hardware level, cloud-based servers are replacing expensive on-premise servers that companies formerly had to purchase and manage themselves. Software-wise, an increasing number of software-as-a-service (SaaS) providers are offering turnkey solutions to complex tasks, including website building, inventory management, sales leads development, targeted marketing, accounting and so on. These services drastically lower the technical barrier and labor cost for start-up DTC brands. Additionally, the boom of social media and streaming services provide brands with a multitude of marketing platforms and breeding grounds for both brand-produced content and user-generated content (UGC), which significantly improve the reach of brands to their customers.

.

CHALLENGES THAT DTC BRANDS ARE FACING

With the huge successes achieved by early DTC entrants, many founders are optimistic about applying the DTC model to every product category. The competition in the DTC space is getting increasingly heated. After seeing the disruptive power of the DTC model, more and more industry veterans are joining the race while leveraging their industry expertise and experiences. Thus, the barrier to entry and the cost of competition in the DTC landscape keep getting elevated, making it significantly more difficult for brands with little prior industry experience to take off.

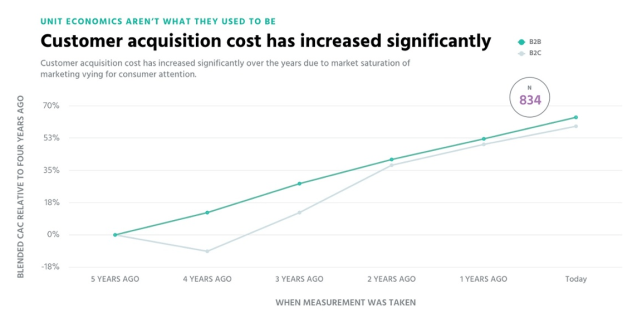

Marketing is one of the cost items that has seen the most drastic increase due to the heightened competition, as almost all DTC brands are pouring money into Google and Facebook to compete for consumers’ attention. According to an executive at Curology, the cost per thousand impressions (CPM) on Facebook has seen a 30 to 50 percent hike over the course of a few years. The number of advertisers on Facebook has grown from 1 million to 6 million from 2012 to 2018 (3). Seeing decreasing return on investment, brands are either cutting down their social media promotion budgets or switching to traditional offline marketing channels, including direct mail, podcasts, radio, TV and even out-of-home advertisements.

Additionally, as more and more brands are competing in the same product category with similar value propositions packaged into similar aesthetics, it becomes increasingly difficult for brands to differentiate themselves from their competitors in both the product development and the business model departments. One Casper is disruptive, but choosing between Casper, Tufts and Needle, Purple, Eve, together with 100 other mattress DTC companies is just as familiarly chaotic and confusing as shopping at a Mattress Firm’s store.

DTC brands also need to maintain their brand identity during the rapid growth period. DTC brands are enjoying a huge popularity right now because they are smaller and novel, which is in stark contrast with the corporate style of the industry incumbents. However, as DTC brands keep expanding their product offering and their market share, they will likely run in increasingly similar ways to corporations, which could gradually diminish their fresh appeal. Thus, DTC brands have to dance at a tempo that is neither too quick to erode their quality and identity, nor too slow to lose out to the competition. Finding and maintaining such a balancing point for growth is not intuitive. The Honest Company lost its unicorn status in 2017, after the brand expanded into the lifestyle and home markets and ran into quality problems with its baby wipes, one of the founding products of the company. The misstep caused the company’s valuation to dip, forcing the company to slim down the product line and refocus on the quality and R&D of its child-care product lines.

Another challenge when it comes to scaling is the coordination of the infrastructure and partner networks for manufacturing and the supply chain. Many DTC founders do no have prior experiences with managing such complex and large-scale operations. Additionally, the global supply chain and distribution networks are still dominated by big brand names. With much smaller sales volume, it would still be very difficult for DTC brands to compete for supply chain resources with legacy brands. Moreover, with the direct model, the sorting and handling process will vary greatly from the conventional logistical process designed for the traditional retail distribution mode. Glossier has run into issues keeping up with the unexpected influx of demand from customers and had to issue an open letter to its customers explaining the struggles the company is facing.

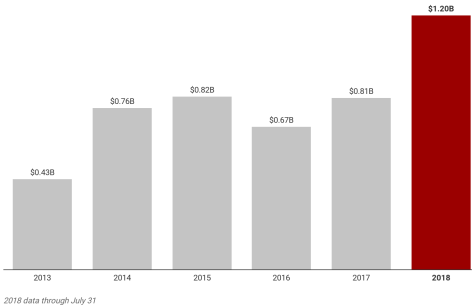

Last but not least, DTC brands are often backed by technology venture capitalists, who do not necessarily have a good understanding of the industries DTC brands inhabit. VC money has flooded the DTC landscape, with 2018 being a record-breaking year seeing $1.2 billion of funding going towards young DTC companies in the first eight months. Unrealistic expectations and the lack of a coherent valuation framework for DTC companies often lead to sky high valuations that are frowned upon by industry incumbents, thus hurting the chances of DTC companies to be acquired by industry incumbents at a reasonable price.

.

WHAT DOES IT MEAN FOR TRADITIONAL BRANDS?

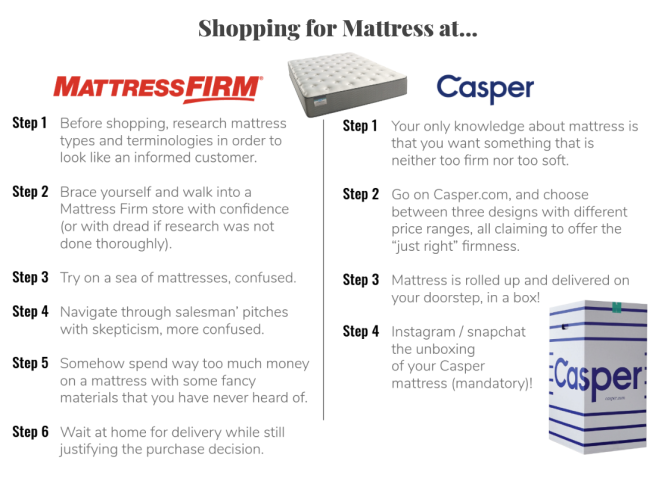

“Big brands are being nibbled to death”, writes the Interactive Advertising Bureau (IAB) in a loud and clear statement from a recent report on the rise of the DTC economy. For many legacy brands, the loss of sales and market share is painfully palpable, especially for CPG brands that have historically low touch with their consumers and are heavily dependent on downstream distributors and retailers. Just over the course of 6 years, 100-year-old Gillette lost over one-fifth of its market share to Harry’s and Dollar Shave Club, which were founded after 2010 (5). Additionally, according to a report in 2015, 90 percent of the top 100 CPG brands reported loss in market share, and 62 percent of them experienced declining sales.

However, opportunities are also emerging for legacy brands in this pivotal time. For example, for the high-touch fashion industry, especially within the luxury fashion segment, brands are seeing increasing potential in leveraging the DTC model to have a higher degree of control of their storytelling with consumers. Across the retail landscape, the DTC model is disrupting the pecking order in the retail industry, and legacy brands have to adapt to stay afloat.

CHALLENGES FACING LEGACY BRANDS

One of the biggest challenges that legacy brands face is the loss of their relevance to customers over the competition from DTC brands. The relevance loss could come from the mis-positioning of their product offerings,tone-deaf marketing strategies and the diminishing of their brand identities.

With the heavy dependence on retailers, legacy brands usually lack direct distribution channels where they can interact and collect first-party data from customers. Hence, when making product development decisions, legacy brands have only vague and murky consumer data to work with, ending up with vast and somewhat redundant product portfolios with hits and misses interspersed. Additionally, without direct distribution channels, brands do not have their finger on the pulse of consumers and are slow to catch up with macro consumer trends, some of which include, for example, an increasing demand for healthy, environmentally friendly and ethically produced products. As a result, the product offerings of legacy brands become less attractive or relevant to their customers.

From a marketing point of view, legacy brands also face challenges of adjusting the dynamics between themselves and consumers. For a long time, legacy brands have been used to maintaining one-way communication with their consumers through mass media outlets. However, this communication style is increasingly deemed obsolete or even condescending by today’s consumers, who prefer to have a bidirectional discussion with brands or even have a direct say to influence the brands. Legacy brands are clearly still adjusting to this power shift between brands and consumers, and the adjustment period is not without mishaps. For example, Pepsi’s failed attempt to attract millennials by flirting with the concept of protest during a politically tumultuous time shows the brand’s insensitivity and misjudgements towards social issues. As today’s political environment gets increasingly complicated and social issues are widely discussed, historically politically disinterested legacy brands now have to walk on eggshells, while learning to carve out a path for their marketing strategy to engage consumers with political stances.

Pepsi’s advertisement created massive backlash (image source: SBS)

Most importantly, legacy brands are losing their brand identity. Historically, legacy brands tend to be product-driven, instead of brand-driven or identity-driven. It is hard to describe the characteristics and personalities of legacy brands, as they have been flooding our lives with their products and claiming that this is the default of commerce. However, today’s customers are more and more buying from brands that they identify with, or even see their purchase as a vote for supporting the brands’ mission and practices. Hence, nowadays, all brands need to have a voice. Additionally, even as legacy brands revisit their brand history and come up with a brand identity, it will be increasingly difficult for them to compete for customers’ shortening attention spans to broadcast their identities with the DTC brands and other attention sinks such as social media and streaming services.

OPPORTUNITIES FOR LEGACY BRANDS

Whenever disruption happens, it brings forward not only challenges but also ample opportunities for the incumbent players to reposition themselves. Legacy brands should carefully evaluate how a DTC model could benefit their innovation, marketing and distribution strategies, then set up realistic goals and action plans to integrate a DTC platform into their business suite. In the following section, we will identify opportunities in DTC that legacy brands can take advantage of.

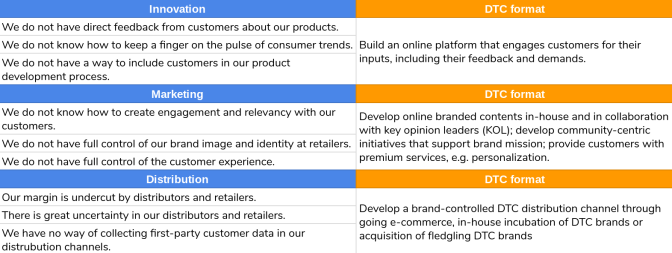

Before implementing the DTC model, legacy brands need to be introspective and evaluate what their current methods of innovation, marketing and distribution are lacking, then decide if a DTC model could complement these aspects of their business. In the table below, we identified a few questions that might arise during the self-inspection phase and the corresponding DTC formats that brands could consider for implementation.

DTC strategy roadmap for legacy brands.

If a brand’s goal is to extract consumer insights for product development purposes, launching an online platform where the brand can engage with customers first-hand and collect customer feedback could provide interesting insights for the brand’s product development. For example, Frito-Lays hosts an annual online competition called “Do Us a Flavor”, where customers can pitch novel flavors on the website: dousaflavor.com, and the winner takes home $1 million in cash or 1 percent of the annual sales of the flavor as rewards. This annual crowdsourcing campaign helps Lays to harvest the most creative ideas from their customers and at the same time generate buzz around their brand and products.

Read more about “Do us a flavor” here.

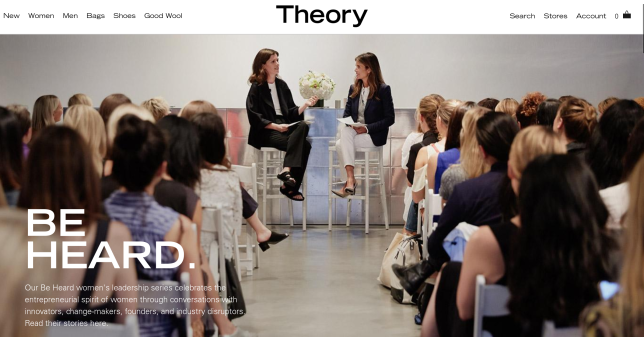

Legacy brands could also adopt a DTC model in their marketing strategy to exert more direct control of the branded contents, brand image and brand identity. Nowadays, customers habitually research products online before purchasing them. And by the time a customer walks into the store, it is highly likely that he or she has already made the shopping decision. “Zero moment of truth” (ZMOT), a term coined by Google, refers to customer’s online researching phase before purchase. Thus, it is important for brands to develop online branded contents either in-house or in collaboration with key opinion leaders (KOLs) that could influence customers’ decision-making during the ZMOT phase. Brands could also launch community-centric initiatives that align with the brand mission. For example, Theory launched the campaign “Be Heard” for its womenswear line, where the brand engages in conversations about leadership and entrepreneurship with female influencers across industries and trades, in an effort to inspire women to take on more important roles in the workplace. This initiative is aligned with the brand’s mission to armor career women with elegant and sleek modern fashion, thus reinforcing the brand’s identity of supporting women in the workforce.

Read more about “Be Heard” here.

Legacy brands could also apply the DTC model to elevate customers’ shopping experiences, such as providing personalization or product-centric services. For example, granola and cereal maker Bear Naked mainly distributes through retailers like Walmart, Target and CVS. In an effort to improve customers’ experience and increase direct contact points with customers, the brand launched a customization website BearNakedCustomer.com that allows for the customization of the ingredients in its granola mix, as well as the canister that the granola is in. Tide, the laundry detergent manufacture, has gone one step future to impress their customers by offering the “Tide Spin” service (now called Pressbox by Tide after the acquisition of Pressbox), an on-demand laundry and dry cleaning services. Compared with the DTC brands that are currently ramping up, legacy brands have much more operational capacity and a larger product portfolio to provide customers with products-as-a-service while creating synergies between different products.

Read more about Bear Naked’s customization service here.

Last but not least, legacy brands could develop their own DTC sales channels by either setting up their own ecommerce real estate for their products, incubating in-house DTC brands or acquiring successful DTC brands in their product categories. Owning a DTC distribution channel allows brands to have a higher margin by bypassing distributors and to hedge against uncertainties in retailers, some alarming examples of which include the bankruptcies of Toy’ R Us, Mattress Firm and Sears. But most importantly, a DTC distribution channel allows brands to own their relationships with customers through direct customer interactions. However, upfront investment in building necessary infrastructure and a network of partners needs to be made for brands to take on the tasks previously performed by their distributors and retailers. Hence, brands should evaluate the economics of adopting a DTC before committing to building a DTC channel.

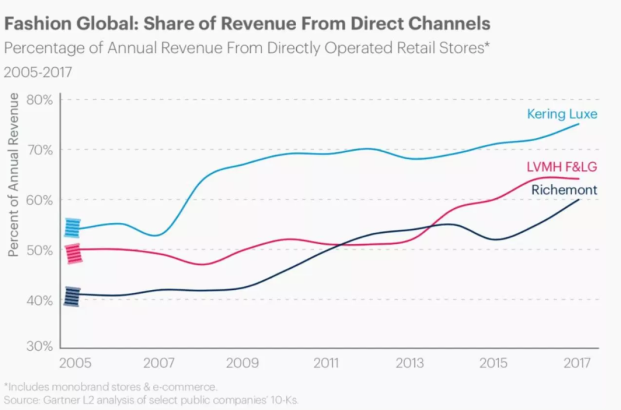

In the luxury sector, top fashion houses awakened to the power of going direct long ago and have since been building directly operated stores and ecommerce channels. Nowadays, they are reaping the rewards of their efforts in going direct by seeing a rapid growth of sales in their direct channels. Kering has seen the share of revenue from direct channels growing from 53 percent in 2005 to around 75 percent in 2017, with LVHM following closely with a 65-percent share and Richemont with a 60-percent share in 2017.

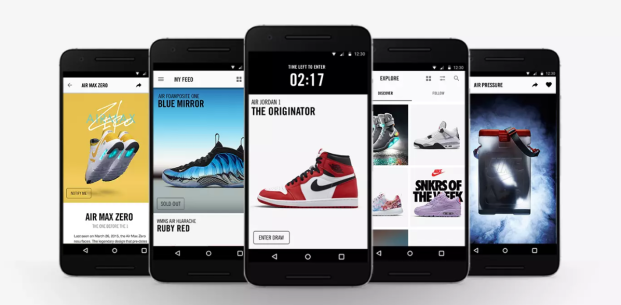

Nike has embraced an even more aggressive DTC strategy that offers customers an immersive “omni-channel” shopping experience both online, offline and in-between. Already owning a fleet of branded stores, the company is muscling into the digital arena by developing apps that serve consumers with retail services, fitness advice and even Nike-themed emojis. Nike has also developed more infrastructures like personal lockers for customers to reserve products online and try them on in person without having to visit a store. In the end, the company’s goal is to provide “personalization at scale” through the seamless integration of physical and digital distribution channels.

.

EPILOGUE

The most significant revolution brought forward by DTC brands is the disruption of the rigid format of the established retail landscape, which forces entrenched brands to put consumers’ needs back into the center of attention. The fact that many founders started DTC brands with limited industry experience and achieved sizable successes is a strong indication that the entrenched players are largely overlooking key consumer trends and slow on adjusting their strategies.

DTC brands do not shy away from niche markets. Instead, they embrace these markets with product and service innovations that directly address the pain points of underserved consumers. Therefore, these DTC brands can easily foster a close bond and loyalty between consumers, which would in turn help brands to expand and grow quickly and organically.

Instead of seeing the DTC trend as a threat, legacy brands need to understand that the retail landscape has fundamentally shifted, and that we are at a pivotal point of the history of retail. The successes of DTC brands serve as a rich learning ground for legacy brands to reflect, react and adapt in preparation for a future full of uncertainties and opportunities.